Why is global capital fleeing coal and exiting oil and gas?

Financial institutions are not acting this way simply for lofty social or environmental reasons, or for ‘virtue signalling’, but rather because it simply makes sense – both in terms of basic economics and in terms of climate change risk.

Last weekend Malcolm Turnbull said on the Insiders program “with the departure of Murdoch’s man from the Whitehouse, Morrison doesn’t have to go on with all this bullshit about a gas-led recovery which is just political piffle. This is the time to pivot”.

We completely agree with that statement (refer earlier post ‘A Rent-Seekers Honeypot’) Here are some more reasons why Morrison should ‘pivot’.

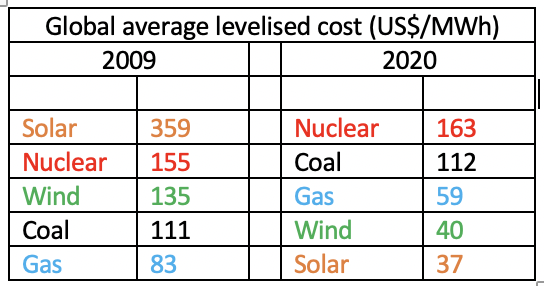

“While it’s useful to compare the current operating costs of generating one unit of electricity (a megawatt-hour – MWh) by existing coal, oil, gas, nuclear, wind, solar and hydro plants, it’s more useful to compare the ‘levelised cost of energy’. The levelised cost includes not only today’s operational costs but also the cost of building, servicing and decommissioning the plant throughout its entire expected life. The average global levelised costs of utility-scale solar, wind, coal and gas in US dollars in 2009 and 2020 are shown below.

The levelised cost of nuclear and coal have changed very little over the 11 years but the other three have become much cheaper, particularly solar which has gone from being the most expensive to the cheapest. In fact, the current operating cost of an existing coal plant is US$41, more expensive than the whole life cycle levelised cost of wind and solar.

No wonder the smart money is fleeing fossil fuels.” Peter Sainsbury in P&I public policy journal, 08 November 2020

The views and opinions expressed here are solely those of the author.